Divide this text into sentences and correct mistakes: "Edit your documents with Docs right inside of PDF filler. Any word or Doc can be edited with Docs without leaving PDF filler. Use all of Docs' word processing tools to complete your document. Then, use PDF filler's powerful annotation tools to fill, highlight, sign, and more. You can also print, send, and save your document with PDF filler's export tools.

Award-winning PDF software

PDFfiller corporate login Form: What You Should Know

The estate of a U.S. citizen or resident must file Form 706 for estates of the decedent that exceed the exclusion amount for an estate or gross estate, adjusted taxable gifts and specific exemptions. If the Dec 12, 2025 — Do I have to file a Form 706 for an estate that has an adjusted gross estate and one that is not? No. If you make 60,000 or less, then you do not need to file a Form 706. The exemption amount does not apply to the decedent's income or to the decedent's estate. Your gross estate, specific exemption and Sep 30, 2025 — What about tax on gift or inheritance tax paid to a foreign decedent? Gift tax is an estate tax that is imposed on a person who inherits property in a foreign country that was transferred to or from a foreign individual or a foreign estate. The tax is imposed without regard to whom the heir is. Any decedent who died on or before January 1, 2017, will not be affected by this The estate of a U.S. citizen or resident must file Form 706 for estates of the decedent that exceed the exclusion amount for an estate or gross estate, adjusted taxable gifts and specific exemptions. If the estate of a U.S. citizen or resident must file Form 706 for estates of the decedent that exceed the exclusion amount for an estate or gross estate, adjusted taxable gifts and specific exemptions. If the estate and GST tax paid from all U.S. gift taxes to any foreign decedent with an estate in excess of the exclusion may be included in the gross estate. If you are unable to file Form 706 Form 706 is the best way to have an accurate estate tax return; it's the fastest way to file and the easiest way to verify that you've properly reported your estate taxes from the last year or two. You file it within 9 months after the date of the decedent's death, even if it's been more than 9 months since death. Your return does not have to be filed every year, as long as you file it within 9 months after the date of the estate and GST tax paid from all U.S. gift taxes to any foreign decedent with an estate in excess of the exclusion may be included in the gross estate.

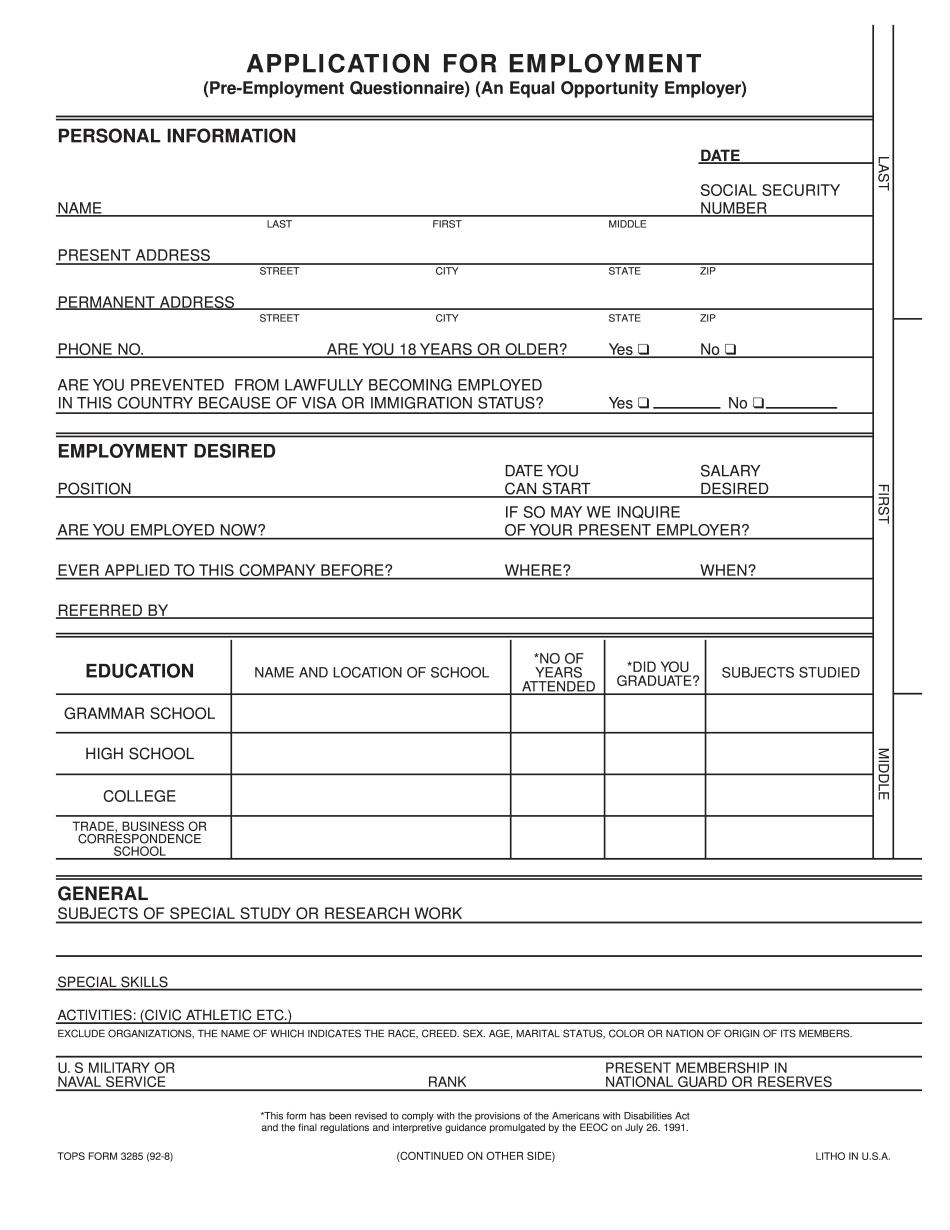

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do LITHO Tops Form 3285, steer clear of blunders along with furnish it in a timely manner:

How to complete any LITHO Tops Form 3285 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your LITHO Tops Form 3285 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your LITHO Tops Form 3285 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing PDFfiller corporate login